What is CFA?

Chartered Financial Analyst (CFA) credential is the most respected and recognized investment management designation in the world. This program is offered by CFA Institute, USA.

What is the difference between CFA and CA?

Though both CFA and CA sound similar, the works they do differ. CFA is run by CFA Institute Virginia whereas CA is run as per the country.There are 3 levels in CFA. The minimum duration one can complete all 3 levels is 18 months if level 1 is taken in December. CA takes 4 or more years to be completed successfully. The total duration of exams in CFA is at least 18 hours if taken continuously whereas each exam at each level is of 3 hours for CA. CFA exams are available only once a year for level 2 and level 3 but level 1 is offered twice a year. CA exams are taken as per the policy of the CA board of the particular country.

CFA designation is globally recognized whereas CA designation has confined recognition. CA of Nepal is only recognized within the boundary of Nepal but you can compete globally with your CFA designation. The CFA charter holders mainly deal with the financial analysis and investment related jobs whereas Charter Accountants mainly deal with accounting, auditing and taxation. You should be clear about your career choice before you jump into one of these.

What is the difference between CFA and MBA?

It is really difficult job to choose the right pathway after the completion of bachelor‘s degree. The main dilemma for the students will be whether to focus on career or focus on enhancing the academic background. Most business students in Nepal after their bachelor level join the master’s degree in the business discipline. Because of the competitive nature of the job market today the demand of specialized candidates is very high. MBA is the first choice of the students who pursue the graduate study in business; on the other hand the choice of joining CFA is in the increasing trend. It is necessary to know what you really need in order to be what you want to be. There is vast difference between CFA and MBA.

Time

The duration for the CFA course is at least 18 months if you register for the December exam for level 1. MBA is structured for 2 years and is further divided into semesters or trimesters. There is certain number of years within which you have to complete your MBA but for CFA there is no such limit. You can take CFA exam as long as you do not clear all three levels. You have to be a fulltime student for MBA. CFA course is flexible and allows you to work fulltime. But the CFA Institute recommends studying at least 300 hours before showing up for the exam. Time management is a key for the successful completion of CFA program.

Course of study:

MBA mainly covers the administrative area of business. It provides skills necessary for successfully running the business. There are various areas of specialization in MBA such as accounting, human resource management, finance, marketing etc. Among these only MBA finance can be compared to CFA because other specialization areas do not focus in the core finance and have their own importance in respective field. If we compare MBA finance Vs CFA the course of studies in MBA does not go deeper into the finance. The students will have to choose from specialization area only in the second year and limited to only 3 specialization subjects. But the CFA course of study focuses totally in finance from the very first level and goes deeper into the subject area as the level increases. CFA course of study is more practical based which equips the candidates with the analytical tools and knowledge to become a successful portfolio manager, analyst etc.

Cost Vs Value:

Since the competition is in the global market people are competing across the globe to become the best. Competing globally requires you to possess something that is recognized globally. The world market place always seeks the candidates from the top recognized universities and colleges. In that case the MBA degree from Nepal may lack strength to get the recognition. But CFA charter being one of the most prestigious certification is recognized globally and is a strong asset to compete globally. The cost for the completion of CFA levels could be around 3 to 5 lakhs in the Nepali context depending up on the registration timing and prep provider’s fees. On the other hand the total cost for the completion of MBA is more than 5 lakhs in almost all of the colleges and universities in Nepal. Talking in global scenario it costs more than $100,000 to complete MBA from the top ranked colleges in the USA which is much greater than the cost of completion of CFA. And the interesting thing is that the CFA charterholders are recognized in the same way as the MBA graduates from the top ranked colleges in the global market.

Compensation:

Salary figure always is the measuring scale for the value of the degree or certifications i.e. you must want to know what you will make when you are holder of the degree or certification. The following table is taken form businessinsider.com which comparatively summarizes the average pay scale of CFA and MBA.

This table shows that the person with only CFA but no MBA is earning from 15000 to 27000 more than the person with MBA but no CFA. Adding CFA and MBA really boost these figures.

Jobs:

The strength of MBA degree cannot be underestimated since this can open the door in all kinds of sectors. MBA graduates are endowed with the management skills that really can enhance them to become as successful managers and CEOs. CFA charterholders are experts in the in the area of investment management, equity research, investment banking etc., so most of these companies put CFA charterholders as the first priority in their list.

Which one is better for you?

It really depends on which career you want to choose and what you want to learn before jumping into the conclusion. CFA is like jumping in the deep but narrow well whereas MBA is like jumping in the shallow pond which is broad. Each choice will land you in the different level of knowledge. If you are looking for investing your career in the equity research, investment management, investment banking, risk management etc. CFA obviously is the best choice for you.

What is the passing rate of CFA examinations?

Since 1963 to 2016 the average passing rate is 42%, 46% and 58% for level 1, level 2 and level 3 respectively. Since 2007 to 2016 the average passing rate for CFA Level 1, Level 2 and Level 3 is 40%, 43% and 51% respectively. For 2016 June it is 43%, 46% and 54% for respective levels.

How do I earn CFA Charter?

In order to be a CFA charterholder one must pass all levels of CFA exam and must have 48 months of experience in the position of investment decision making. One must agree to follow the CFA Institute Code of Ethics and Standards of Professional Conduct and must become a regular member of CFA Institute and apply for membership in a CFA member society.

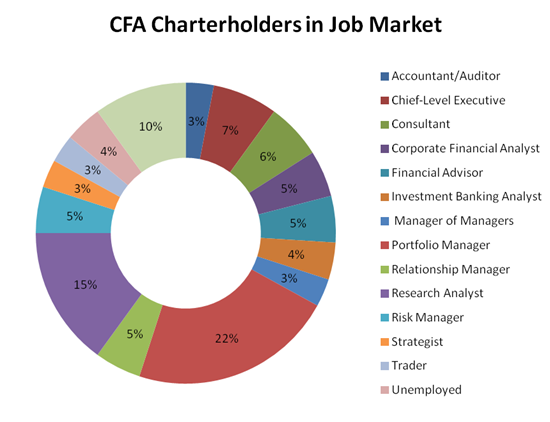

What kind of job do the CFA charter holders do?

According to the CFA Institute

Are there jobs available in Nepal after completing CFA?

As the capital market is in the growth trend, the demand for the specialist of financial market is growing in Nepal. Since there are only few CFA charterholders in Nepal the demand is high in the current market. Capitals, mutual fund and Merchant Bankers are hiring the CFA candidates since they seek competitive candidates.

Where should I work to get the required qualification of 48 months work experience?

In order to fulfill the necessary requirement of 48 months of relevant work experience the candidates must have full-time work experience in Investment decision making position. This includes the job position as Research Analyst, Fund Manager, Portfolio Manager, Credit Analyst, Investment banker etc.

What is the calculator policy for the exam?

CFA Institute has strict policy regarding the calculator in exam. Only the prescribed format of calculator is allowed. CFA Institute has prescribed following two types of calculators:

Texas Instruments BA II Plus (including BA II Plus Professional)

Hewlett Packard 12C (Including the HP 12C Platinum, 12C Platinum 25th anniversary edition, 12C 30th anniversary edition, and HP 12C Prestige)

·

How many CFA charterholders are there worldwide and in Nepal?

Currently there are around 135,000 CFA charterholders worldwide. In Nepal the number of CFA charterholders is 5.

Do I need to have finance background to join Level 1?

Having good background of finance is always advantageous for the candidates for the level 1. However, even if you do not have background in finance, there is nothing to be worried about. The Level 1 covers very basic concept of the course study so, with time and hard work the course of study can be easily mastered. There are many charterholders worldwide, who came from different backgrounds such as engineering, information technology etc.

Is there any test center in Nepal?

CFA Institute has provided the test center in Nepal for June exam. But for the December Level 1 exam the candidates have to find the nearby countries. There will be few test centers in India for the December exam. Most of the Nepali candidates taking the December exam have registered for Delhi.